Understanding Cryptocurrency Exchanges

Cryptocurrencies are platforms that facilitate the purchase of cryptocurrencies and other digital assets like non-fungible tokens (NFTs) using fiat or digital currencies. With cryptocurrency exchanges, purchasing, and trading cryptocurrencies will be easier.

There are two types of exchanges, Centralized Exchanges (CEX). These types of exchanges can be likened to a stock exchange, like the Nasdaq exchange but for cryptocurrencies, acting as intermediaries between buyers and sellers. CEXs make their money from commissions and transaction fees charged. Both Binance.US and Coinbase are examples of centralized exchanges.

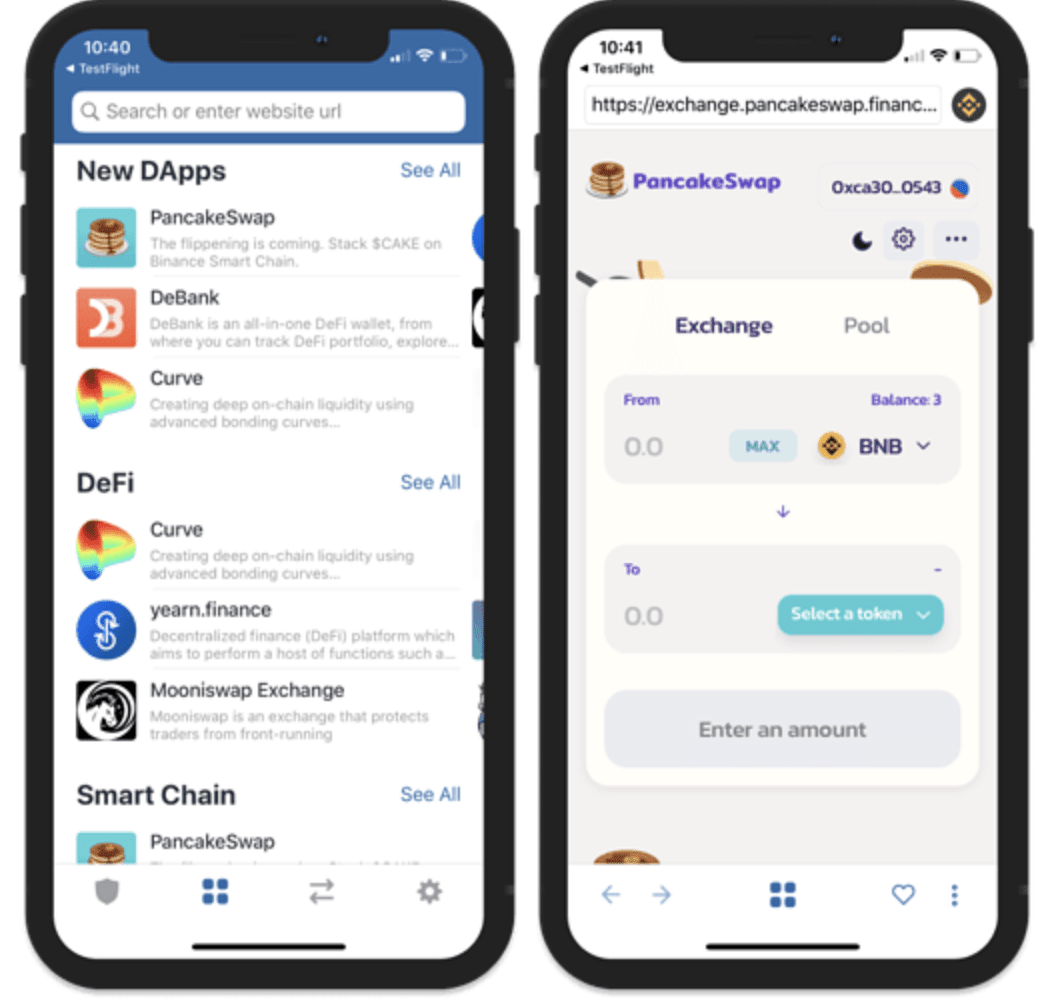

Decentralized Exchanges (DEX) eliminate the need for intermediaries, allowing users to buy and sell cryptocurrencies via peer-to-peer transactions. Examples of DEXs are Uniswap, PancakeSwap, dYdX, and KyberSwap.

Coinbase Pro vs. Binance.US

Coinbase Pro is an advanced platform offered by Coinbase, the biggest U.S.-based crypto exchange launched in 2012. Former Airbnb engineer Brian Armstrong and Fred Ehrsam, a former trader at Goldman Sachs, founded Coinbase.

Coinbase Pro is a fast, reliable, and secure platform for trading cryptocurrencies. The base Coinbase platform only offers essential services to purchase, hold, and use cryptocurrencies, while Coinbase Pro is used for trading cryptocurrencies.

Binance.US is the U.S. subsidiary of Binance, the world’s largest digital asset exchange by trading volume. However, Binance.US split from its parent company Binance in 2019 and is now a separate company with its own management.

Binance.US was initially explicitly launched for United States users because of the country’s more burdensome local jurisdictional regulations. It is one of the biggest competitors of Coinbase Pro in the United States and attracts users with lower trading fees.

Binance vs. Coinbase — Which should you choose?

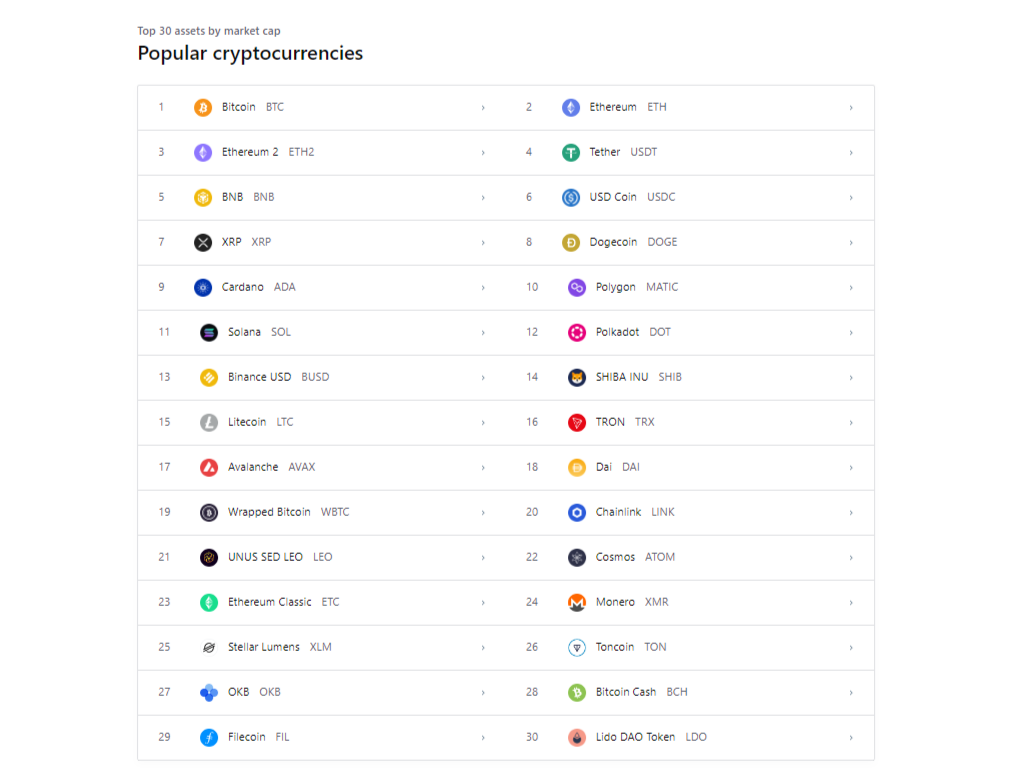

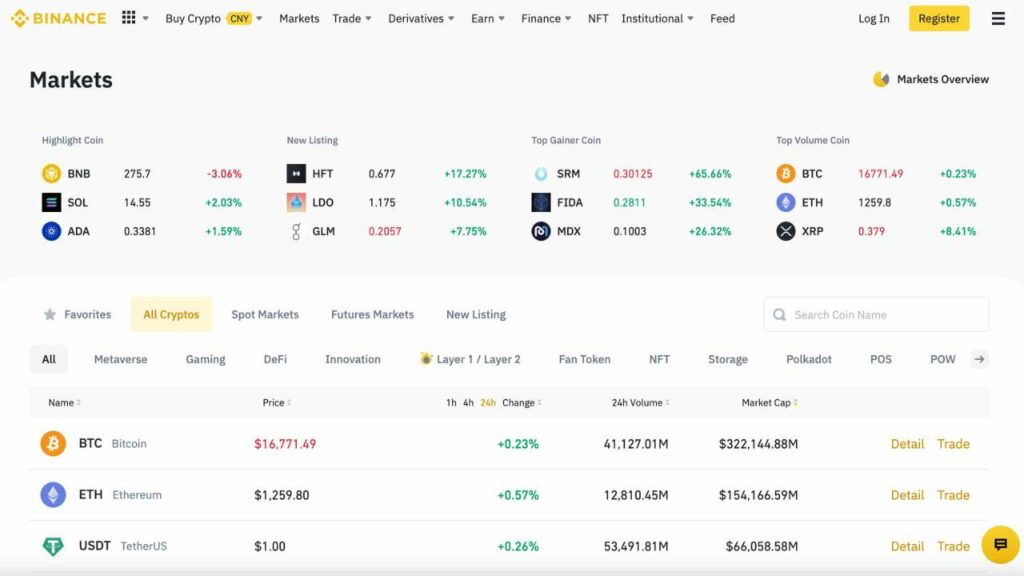

Finding the best exchange to buy and hold digital assets like Bitcoin (BTC), Ethereum (ETH), or Tether (USDT) is one of the first stages of investing in cryptocurrencies. Binance and Coinbase are two of the biggest crypto exchanges by trading volume, with hundreds of billions of dollars traded of them every year.

Both Binance and Coinbase are excellent platforms and offer very similar services. We’ve put together this article to help you make that decision.

Coinbase vs. Binance: Which Cryptocurrency Exchange Is Better?

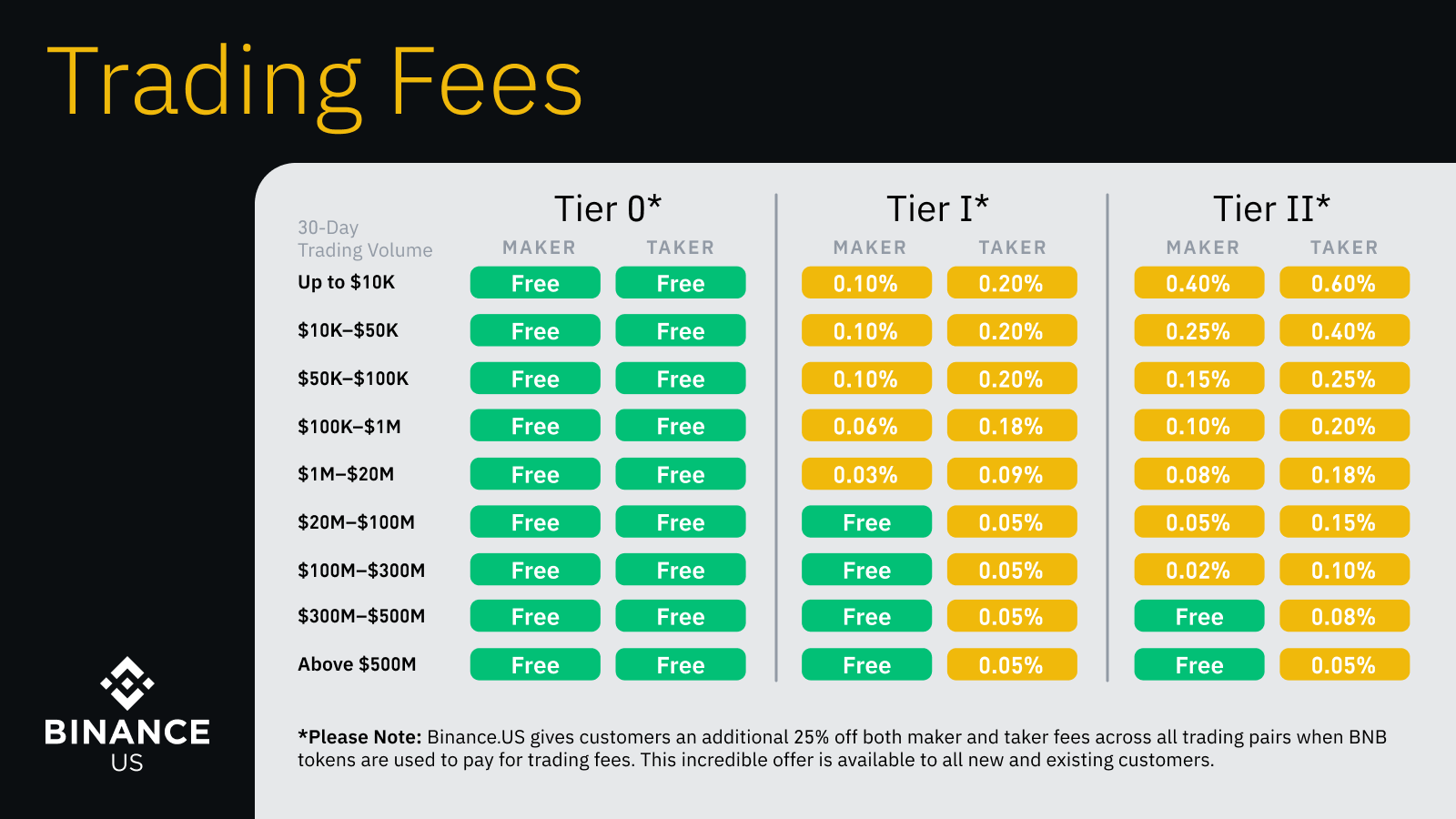

Binance.US and Coinbase are the two leading crypto exchanges in the crypto world, with neither being better than the other. Both have some advantages and features over the other. The better cryptocurrency exchange will be the one that best meets your requirements.

How does Coinbase Pro work?

Coinbase Pro is an advanced platform of Coinbase built for professional crypto traders. Coinbase Pro has all the advanced trading and charting tools to trade on the go, including real-time candles, depth charts, order books, as well as limit and market orders.

If you already have a Coinbase account, you only need to upgrade to get access to these advanced trading features. While owning a Coinbase Pro account is not charged, transaction fees range between 0% to 0.60% per order.

Binance vs. Coinbase: Cryptos available

If you want to buy, sell, and trade the more popular cryptocurrencies, you won’t have a problem with both cryptocurrency exchanges. Binance.US and Coinbase support the most popular cryptocurrencies, including Bitcoin (BTC) and other top ten altcoins excluding XRP and Binance Coin (BNB) for Coinbase.

However, if you are interested in smaller altcoins, Coinbase is the better exchange, with over 250 available cryptocurrencies. Binance offers over 600 cryptocurrencies, but Binance.US supports less, with only about 130 cryptos available.

7 important differences between Coinbase Pro and Binance.US

The 7 most important differences between Coinbase Pro and Binance.US are:

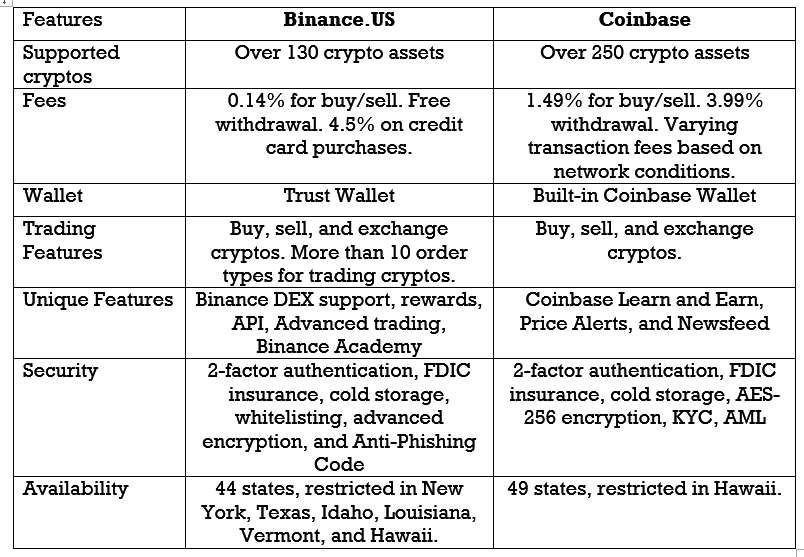

Binance vs. Coinbase Pro fees

Binance offers significantly lower fees than Coinbase Pro. For deposits via wire transfer, Binance.US doesn’t charge, while Coinbase charges $10. Binance charges a $15 fee for domestic wire withdrawals, while Coinbase charges start at $25.

Bank transfers on available fiat currencies are free on exchanges. However, Binance.US charges a 4.5% fee when buying crypto with a credit card, while Coinbase charges 3.99%.

Taker fees on Coinbase ranges from 0.05%. Binance.US charges a maximum taker/maker fee of 0.1%.

Conversion and withdrawal of crypto to cash on Coinbase incur a 1% fee in addition to standard network fees. However, on Binance.US, users only pay network fees.

Binance vs Coinbase taxes

Binance and Coinbase issue tax forms to their users above the $600 threshold the Internal Revenue Service (IRS) set. Binance.US offers a Tax Center to make it easy for users to file their crypto taxes with free customizable reports. Similarly, Coinbase Taxes helps users understand which of their activities on the exchange are taxable.

Cryptocurrencies available

Binance.US supports over 130 digital assets, more than many exchanges in the United States. Coinbase support more cryptocurrencies than Binance.US, with more than 250 listed on the exchange.

They both support the top crypto assets, but their lists of supported cryptocurrencies are frequently revised as regulators seek to classify assets as securities and commodities. The exchange issued Binance coin is not available on Coinbase.

Transaction and withdrawal fees

Binance.US charges 0.10% spot-trading fees and 4.5% for debit card purchases. There are no fees charged for withdrawals when using ACH bank transfers, while wire withdrawals cost between $10 to $15.

Coinbase charges 1% for crypto withdrawals and $25 for domestic wire withdrawals. However, other transactional fees are undisclosed and vary based on the crypto and network conditions at the time of the transaction.

Overall, Binance.US has a more straightforward and clearer fee structure than Coinbase Pro, which is ‘calculated at the time you place your order.’

Coinbase and Binance.US Advanced Trade

The basic Coinbase platform only supports the regular trades like buying, selling, storing, staking, and exchanging cryptocurrencies.

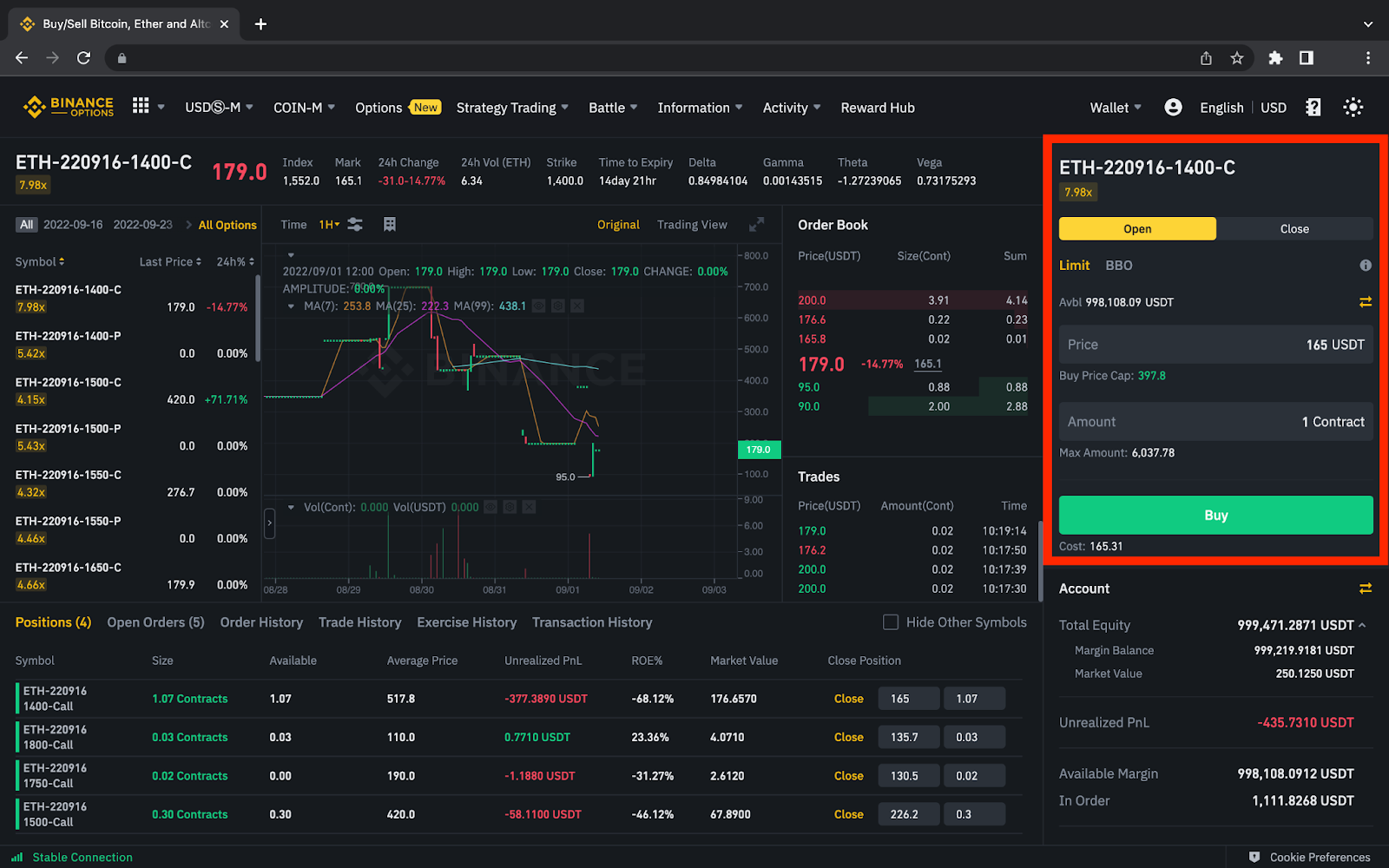

Binance.US is built for advanced trade supporting limit orders, market orders, stop-limit, P2P, and one-cancels-the-other (OCO) orders. This makes Binance.US the more suitable platform for advanced trading.

Trading Tools

Binance.US offers more advanced trading and charting tools for adding hundreds of indicators and overlays. Binance.US also grants users access to TradingView charts.

Coinbase doesn’t support many tools for trading as Coinbase. Coinbase Advanced trade is limited only to users who upgrade to the pro platform.

Binance vs. Coinbase: Wallets

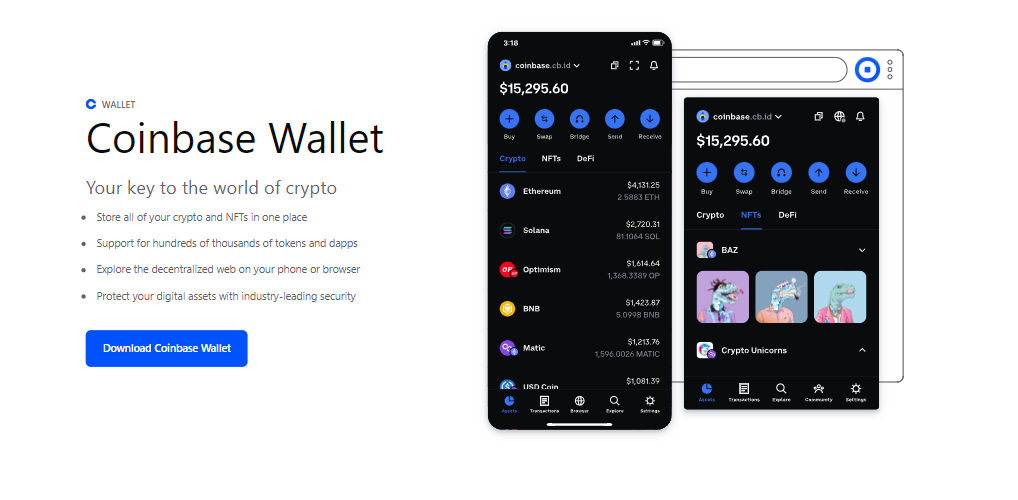

Both crypto exchanges offer their own custom wallet applications. Both the Coinbase Wallet and the Binance Trust Wallet applications are hot wallets – that store digital assets online.

The main difference is that the custodial wallet offered by Coinbase works like the exchange, is simple, and only allows users to buy, sell, store, and exchange cryptocurrencies and NFTs. The mobile wallet issued by Coinbase now integrates the broader Coinbase ecosystem.

Trust Wallet offers the same features but integrates support for the Binance Smart Chain ecosystem. This means that users can access DeFi, dApps, NFTs, and more using both wallets.

Coinbase Account Terms

As a regulated exchange, there are terms users must meet to open an account on Coinbase. Firstly, individuals must be above 18 years and complete the necessary verification procedures. The Coinbase of wallet can also used only to store, send, request, or receive the exchange’s support.

As part of the Coinbase account terms, users own the digital assets in their wallets but are custodied by Coinbase for their safekeeping. Read more on the Coinbase Agreement here.

Binance vs. Coinbase: Security

As top crypto exchanges, both Binance and Coinbase boast industry-leading security features. The two exchanges support 2FA, biometric access, cold storage support (for storing assets offline), and FDIC-insured USD balances.

In addition, Binance.US has device management and address whitelisting, while Coinbase integrates AES-256 encryption for digital wallets for additional security of their platforms.

Available States

Coinbase is available in all states in America except Hawaii, while Binance.US is available in 44 states and is restricted in New York, Texas, Idaho, Louisiana, Vermont, and Hawaii.

Binance vs. Coinbase: Top Differences

Binance and Coinbase are built for different groups of crypto traders. Coinbase takes on a more simplistic approach, making it suitable for new crypto traders and investors. On Coinbase, you can only buy, sell, send, receive, and exchange cryptocurrencies.

On the other hand, Binance was built with more advanced traders in mind. The exchange supports more advanced trading, including limit orders, market orders, stop-limit orders, margin trading, post-only orders, peer-to-peer trading, and more.

Binance.US has a better fee structure than Coinbase, with the former offering lower fees. They have different wallets, with the Binance Trust Wallet offering more than crypto support, including support for the Binance Smart Chain ecosystem, while the Coinbase Wallet is easy to use.

Binance.US Unique Features

Binance.US is integrated with the Binance DEX offering users access to top DApps, NFTs, cross-chain bridge solutions, Binance Smart Chain, trading, and crypto purchases with MoonPay. The exchange also has the Binance academy to teach newbie and experienced traders.

The exchange rewards users of the platform with frequent airdrops, challenges, and giveaways. Binance.US also offers more advanced trading tools, indicators, and access to TradingView charts.

Coinbase Unique features

In addition to the regular features of a crypto exchange, Coinbase adds a Learn and Earn program that offers users the opportunity to watch educational videos on cryptocurrency projects and earn small amounts of cryptos.

Coinbase also integrates live price alert notifications and a built-in newsfeed service into its platform to keep users updated with all the happenings in the crypto space.

Who Should Pick Coinbase?

Coinbase has an easy-to-use platform, charges much lower fees than the competition, and offers excellent educational materials about the crypto market, making it a great crypto exchange for beginner crypto investors.

Coinbase staking

Coinbase offers our customers the ability to stake supported proof-of-stake cryptocurrencies and earn rewards of up to 6% annual percentage yield (APY). DeFi yield is also supported by Coinbase.

Users can stake Ethereum (ETH), Solana (SOL), Tezos (XTZ), Polkadot (DOT), Cosmos (ATOM), Celo (CGLD), Cardano (ADA), USD Coin (USDC), Polygon (MATIC), Kusama (KSM), Near protocol (NEAR) and other assets on Coinbase.

Binance and Security

Binance.US implements end-to-end encryption to ensure that users’ digital assets are secured both in storage and in transit. The Binance platform also uses this measure to secure the personal data of users that enter the platform.

Binace.US also makes use of an Anti-Phishing Code feature to secure the data of users when online. For added security, there are also strict verification protocols and two-factor authentication on Binance.

Do Coinbase Pro and Binance.US report to the IRS?

Yes, the two crypto exchanges are required to report crypto transactions above a stipulated threshold to The Internal Revenue Service (IRS). When a user earns more than $600 on Coinbase Pro or Binance.US via staking, referrals, and other income-generating activities, they are issued a form 1099-MISC to the IRS.

The issuance of Form 1099-MISC is part of the IRS’s plans to enforce compliance and accurate reporting of cryptocurrency-related income and transactions in the United States.

Which cryptocurrency exchange should you choose?

Binance.US and Coinbase are two of the leading cryptocurrency exchanges, with both having an advantage over the other. Binance.US offers more cryptocurrencies and is cheaper than Coinbase. However, Coinbase is easier to use and has more trading options for users, along with more customer service options.

The better crypto exchange might be subjective, but Coinbase offers slightly better services for United States-based users. For advanced high volume traders, Binance may be the better option.

Coinbase security features

Coinbase is a leading cryptocurrency exchange, and it implements a range of security measures to keep the platform and users safe. The platform is built with industry-leading security and encryption to protect the sensitive information of users from being intercepted and decoded by third parties.

For added security, Coinbase also integrates two-factor authentication and biometric security (fingerprint and face recognition) to make wallets more secure. Coinbase also supports the self-custody of private keys to help protect user funds.

To prevent external and internal attacks, Coinbase undergoes regular security audits to identify and address any vulnerabilities that may be on the network. These security features are put in place to protect its 110 million verified users.

Is Binance.US different from Binance?

Binance.US is the United States-based subsidiary of one of the largest cryptocurrency exchanges in the world, Binance. Binance.US was created to offer services to U.S. residents and follows the regulatory framework of the jurisdiction, leading to different services from the international exchange, Binance.

Binance.US doesn’t support leverage (futures) like Binance and offers access to a smaller number of cryptocurrencies due to the regulatory environment. Debit card Purchase also isn’t supported by Binance.US. However, Binance.US offers lower trading fees when compared to Binance.

Coinbase vs. Binance — staking rewards compared

Both Coinbase and Binance support coin and token staking– a proof-of-stake (PoS) consensus mechanism used to process transactions, create new blocks, and secure a network, in exchange for rewards in the staked cryptocurrency.

On Coinbase, users can stake only 11 cryptocurrencies, while Binance.US allows users to stake more than 25 different assets. In terms of staking rewards, Coinbase offers users an opportunity to earn as much as a 6% APY.

Binance.US offers both DeFi staking and locked staking as well as higher staking rewards than Coinbase, with APYs of up to 15%. Please note that the rewards for staking will vary depending on the cryptocurrency, network conditions, and staking configurations.

Is Coinbase Pro different from Coinbase?

Coinbase Pro and Coinbase share the same parent company, Coinbase Global, Inc., but they are entirely different platforms designed for different groups of individuals. Coinbase was designed with beginner investors in mind, offering a clean, simple interface to buy, sell, and transfer cryptocurrencies.

On the other hand, Coinbase Pro was created to meet the needs of experienced crypto traders. Coinbase Pro spots more advanced charting features and more trading options aimed to give cryptocurrency traders more control over their trades.